Life insurance is an essential financial tool that provides financial security for your loved ones in the event of your death. It ensures that your beneficiaries, whether family members or dependents, receive a lump sum payment or regular benefits to help cover living expenses, outstanding debts, and other financial needs after you’re gone. Despite its importance, many people remain unsure about life coverage, how it works, and why they need it. In this article, we will break down the key aspects of life coverage, explain why it’s important, and provide insight into how to choose the right policy for your needs.

What is Life Coverage?

Life coverage, or life insurance, is a contract between the policyholder and an insurance company. In exchange for regular premium payments, the insurance company agrees to provide a financial payout, called a death benefit, to designated beneficiaries upon the policyholder’s death. The amount and structure of the death benefit depend on the terms of the policy and the needs of the policyholder.

Types of Life Insurance Coverage

There are various types of life insurance policies, each designed to meet different financial needs. The main types of life insurance include:

1. Term Life Insurance

Term life insurance provides coverage for a specified period, usually ranging from 10 to 30 years. If the policyholder passes away during this term, their beneficiaries receive the death benefit. If the term expires and the policyholder is still alive, the coverage ends, and no payout is made.

Pros of Term Life Insurance:

- Lower premiums compared to permanent life insurance.

- Simple and straightforward coverage for a specified term.

- Ideal for temporary needs, such as paying off a mortgage or supporting children until they are financially independent.

Cons of Term Life Insurance:

- No cash value or investment component.

- Coverage ends after the term, with no benefits if you outlive the policy.

2. Whole Life Insurance

Whole life insurance provides lifelong coverage, as long as the premiums are paid. It also accumulates cash value over time, which the policyholder can borrow against or withdraw.

Pros of Whole Life Insurance:

- Lifelong coverage with guaranteed death benefits.

- Cash value component that grows over time and can be used as a savings or investment tool.

- Premiums remain constant throughout the life of the policy.

Cons of Whole Life Insurance:

- Higher premiums compared to term life insurance.

- Slower cash value accumulation in the early years of the policy.

3. Universal Life Insurance

Universal life insurance combines flexible premiums with a cash value component. It allows policyholders to adjust the death benefit and premiums throughout the life of the policy, offering more flexibility than whole life insurance.

Pros of Universal Life Insurance:

- Flexible premiums and death benefit options.

- Cash value that grows based on interest rates.

- Can be tailored to changing needs over time.

Cons of Universal Life Insurance:

- Requires more management, as interest rates and market conditions can affect the cash value.

- Potential for higher costs if the policyholder doesn’t adjust their premiums accordingly.

4. Variable Life Insurance

Variable life insurance is a type of permanent life insurance that allows policyholders to invest the cash value in a variety of investment options, such as stocks and bonds. The value of the policy and the death benefit can fluctuate based on the performance of these investments.

Pros of Variable Life Insurance:

- Potential for higher cash value growth through investments.

- Flexible death benefits and premium payments.

- Policyholders can tailor their investment strategy based on their risk tolerance.

Cons of Variable Life Insurance:

- Greater risk due to market fluctuations.

- Higher premiums and more complex management.

- Cash value and death benefit can decrease if investments underperform.

Why Do You Need Life Coverage?

While life insurance may seem like an unnecessary expense for some, it plays a crucial role in providing financial stability for your loved ones after your passing. Here are some compelling reasons why you need life coverage:

1. Protecting Your Family’s Financial Future

If you are the primary breadwinner in your household, life coverage can ensure that your family is financially protected in case of your untimely death. The death benefit can help cover ongoing expenses such as housing, education, utilities, and groceries. Without life insurance, your family may struggle to maintain their standard of living or be forced to take on significant debt.

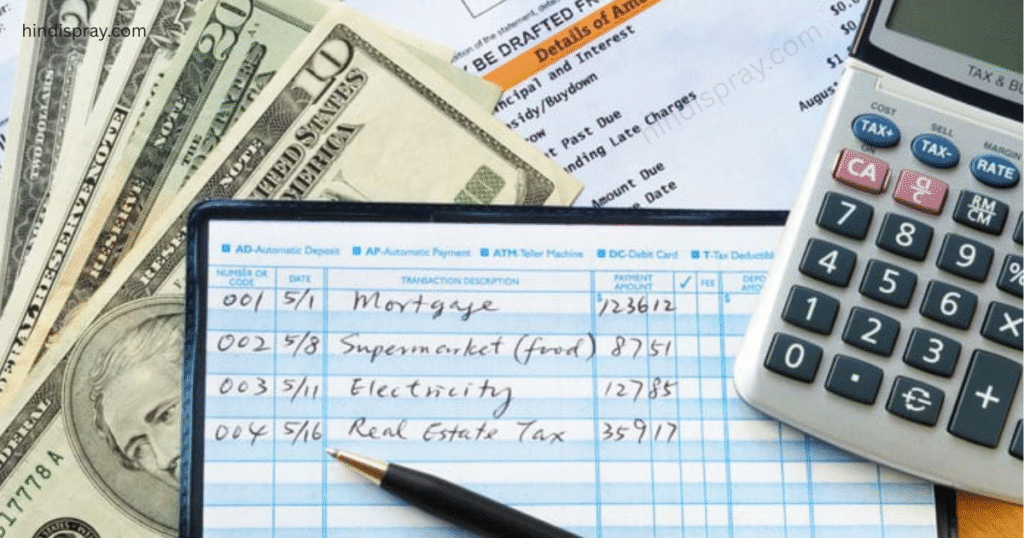

2. Paying Off Debt

Many people carry significant debt in the form of mortgages, car loans, student loans, and credit card balances. In the event of your death, your debts may be passed on to your spouse, children, or other dependents. Life insurance can help settle these debts, preventing your family from bearing the burden of unpaid obligations.

3. Replacing Lost Income

If you contribute to the household income, life insurance can help replace that lost income after your death. The death benefit can provide financial support for your dependents, ensuring that they can continue to pay bills and cover expenses without having to drastically change their lifestyle.

4. Funding Your Children’s Education

Life insurance can provide the funds necessary to ensure that your children’s education is not jeopardized by your death. The death benefit can be used to cover tuition fees, books, and other educational expenses, helping your children achieve their educational goals.

5. Estate Planning and Tax Benefits

Life insurance can be an essential tool for estate planning. The death benefit can be used to pay estate taxes, ensuring that your heirs receive the maximum benefit from your estate. Additionally, the death benefit is generally paid out tax-free to beneficiaries, providing a significant tax advantage.

6. Funeral and End-of-Life Expenses

Funeral costs and end-of-life expenses can be substantial, often ranging from $7,000 to $15,000 or more. Life insurance can help cover these expenses, easing the financial burden on your family during an already difficult time.

How to Choose the Right Life Insurance Coverage

Choosing the right life insurance policy depends on your unique needs, financial goals, and the circumstances of your life. Here are a few steps to guide you in selecting the best coverage:

1. Assess Your Financial Needs

Start by determining how much life insurance coverage you need. Consider factors such as:

- Your annual income and household expenses.

- Debts and mortgages that need to be paid off.

- Educational expenses for your children.

- Final expenses, including funeral costs.

Use an online life insurance calculator or consult a financial advisor to help estimate the coverage amount that suits your needs.

2. Choose the Right Type of Policy

Decide which type of life insurance is most appropriate for you. If you need temporary coverage, term life insurance may be a more affordable option. For long-term coverage with a cash value component, consider whole life or universal life insurance.

3. Consider Your Budget

Life insurance premiums vary based on factors like age, health, and the type of policy. Make sure that the premium fits within your budget, and remember that premiums for permanent life insurance (whole life, universal life) tend to be higher than for term life insurance.

4. Check the Insurer’s Reputation

Choose a reputable insurance provider with strong financial stability. You want to ensure that the insurer will be able to fulfill its obligations when the time comes. Look for an insurer with high ratings from independent rating agencies such as A.M. Best, Moody’s, or Standard & Poor’s.

5. Review the Policy Terms

Before purchasing a policy, carefully read the terms and conditions to understand what is covered, what exclusions apply, and any other important details. Pay attention to the fine print and ask your insurance agent for clarification if needed.

Also Read: What Is An Insurance Rider? A Simple Guide For Policyholders

Conclusion

Life coverage is one of the most important financial tools you can have to protect your loved ones’ financial future. By providing a safety net that can replace lost income, pay off debts, fund education, and cover funeral expenses, life insurance ensures that your family won’t be left with financial burdens in the event of your death. Choosing the right policy requires careful consideration of your needs, budget, and long-term goals. Whether you opt for term life insurance for temporary coverage or permanent life insurance for lifelong protection, life coverage is an investment in peace of mind for you and your family.

FAQs

1. What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specific period and is more affordable, while whole life insurance provides lifelong coverage and includes a cash value component that grows over time.

2. How much life insurance coverage do I need?

The amount of coverage you need depends on factors like your income, debts, number of dependents, and financial goals. You can use online calculators or consult a financial advisor to determine an appropriate amount.

3. Can I change my life insurance policy after purchasing it?

Yes, depending on the type of policy, you can make changes such as increasing or decreasing the coverage amount, converting term life insurance to whole life, or adjusting the beneficiaries.

4. Is life insurance taxable?

The death benefit from a life insurance policy is generally paid out tax-free to the beneficiaries. However, the cash value growth in permanent policies may be subject to taxes if it is withdrawn or borrowed against.

5. Can I have more than one life insurance policy?

Yes, you can have multiple life insurance policies. This can be beneficial if you want to cover different needs at various stages of your life or to supplement an existing policy.