Auto accidents can lead to unexpected medical expenses and lost wages. Personal Injury Protection (PIP) is a type of auto insurance coverage designed to help cover these costs, regardless of who is at fault. It ensures that you receive medical treatment and compensation for lost income without waiting for liability disputes to be resolved. But how does PIP work, and who needs it? In this comprehensive guide, we’ll explore PIP insurance, its benefits, and how it compares to other types of coverage.

What Is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP), often referred to as “no-fault insurance,” is a type of car insurance that covers medical expenses and other related costs after an accident, regardless of who was responsible. It is mandatory in some states and optional in others.

Key Features of PIP Insurance

- Covers medical expenses for injuries sustained in an accident.

- Pays for lost wages if you are unable to work.

- Covers rehabilitation costs related to the injury.

- Includes funeral expenses in case of fatal accidents.

- Provides essential services coverage, such as childcare or household chores if you’re unable to perform them due to injury.

How Personal Injury Protection Works

When you are involved in an accident, PIP insurance kicks in immediately to cover certain expenses. Here’s how it typically works:

Step 1: The Accident Occurs

If you’re injured in a car accident, you should seek medical attention immediately and report the accident to your insurance company.

Step 2: Filing a PIP Claim

To utilize your PIP benefits, you must file a claim with your own insurance company, regardless of fault. This generally requires:

- Proof of injury (medical records, doctor’s report).

- Accident details (police report, photos, witness statements).

- Proof of lost wages (pay stubs or employer verification).

Step 3: Coverage and Payout

Your insurance company will review your claim and reimburse covered expenses up to your policy’s limit. PIP benefits typically have a maximum coverage amount, which varies by state and policy.

Step 4: Coordination with Other Insurance

If you have health insurance, PIP may act as the primary or secondary coverage. Some policies allow health insurance to cover medical bills first, reducing PIP expenses.

What Does PIP Insurance Cover?

Covered Expenses

- Medical Bills – Hospital stays, surgeries, prescriptions, ambulance fees.

- Lost Wages – Compensation if you’re unable to work due to injuries.

- Rehabilitation Costs – Physical therapy, chiropractic care.

- Essential Services – Payment for services like home cleaning or childcare.

- Funeral Expenses – Covers burial and funeral costs if the accident is fatal.

What PIP Does Not Cover

- Vehicle damage (covered under collision or comprehensive insurance).

- Property damage (covered under liability insurance).

- Injuries to others (covered under bodily injury liability insurance).

- Pain and suffering damages (covered in lawsuits, not under PIP).

PIP vs. Medical Payments Coverage (MedPay)

Both PIP and MedPay help cover medical expenses after an accident, but they have key differences:

| Feature | Personal Injury Protection (PIP) | Medical Payments Coverage (MedPay) |

|---|---|---|

| Covers medical bills | ✅ | ✅ |

| Covers lost wages | ✅ | ❌ |

| Covers rehabilitation costs | ✅ | ❌ |

| Covers essential services | ✅ | ❌ |

| Covers funeral expenses | ✅ | ✅ |

| Required in no-fault states | ✅ | ❌ |

PIP provides broader coverage, including lost wages and essential services, while MedPay is more limited to medical expenses only.

States That Require Personal Injury Protection

PIP is mandatory in no-fault states and optional in others. States that require PIP coverage include:

- Florida

- Michigan

- New York

- New Jersey

- Massachusetts

- Pennsylvania

In these states, drivers must carry a minimum PIP coverage amount. In other states, PIP is optional, allowing drivers to decide if they want additional protection.

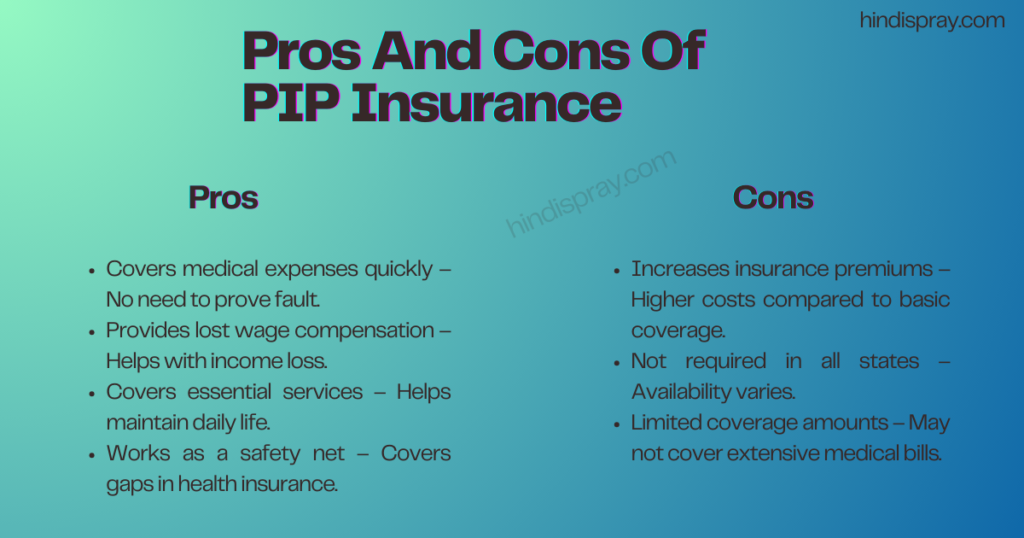

Pros and Cons of PIP Insurance

Pros

✅ Covers medical expenses quickly – No need to prove fault. ✅ Provides lost wage compensation – Helps with income loss. ✅ Covers essential services – Helps maintain daily life. ✅ Works as a safety net – Covers gaps in health insurance.

Cons

❌ Increases insurance premiums – Higher costs compared to basic coverage. ❌ Not required in all states – Availability varies. ❌ Limited coverage amounts – May not cover extensive medical bills.

How Much Does PIP Insurance Cost?

PIP insurance costs vary based on factors such as:

- State requirements – Mandatory states tend to have higher costs.

- Coverage limits – Higher limits increase premiums.

- Driving history – More accidents result in higher rates.

- Insurance provider – Different companies offer varying rates.

On average, PIP insurance costs between $50 and $200 per year, depending on the policy.

Do You Need PIP Insurance?

You should consider PIP insurance if:

- You live in a no-fault state where it’s required.

- You want quick access to medical funds after an accident.

- You don’t have health insurance or have a high deductible.

- You want coverage for lost wages and essential services.

Also Read: Understanding Endowment Policy: Benefits, Features & Types

Conclusion

Personal Injury Protection (PIP) is an essential part of auto insurance that ensures you receive medical coverage, lost wage compensation, and essential service payments after an accident, regardless of fault. While it’s mandatory in some states, it can also be a smart choice in optional states, especially if you lack comprehensive health insurance. Understanding how PIP works can help you make an informed decision about adding this coverage to your auto insurance policy.

FAQs

1. Is PIP the same as health insurance?

No. PIP covers accident-related medical expenses, while health insurance covers general medical needs.

2. Does PIP cover passengers in my car?

Yes, PIP typically covers you, your passengers, and sometimes even pedestrians.

3. Can I use PIP if I have health insurance?

Yes, but some policies require PIP to be used first before health insurance kicks in.

4. Does PIP cover injuries in a hit-and-run accident?

Yes, PIP will cover your injuries even if the at-fault driver is unknown.

5. Can I sue the other driver if I have PIP?

In no-fault states, your ability to sue is limited, but in at-fault states, you may still pursue a lawsuit.